Anúncios

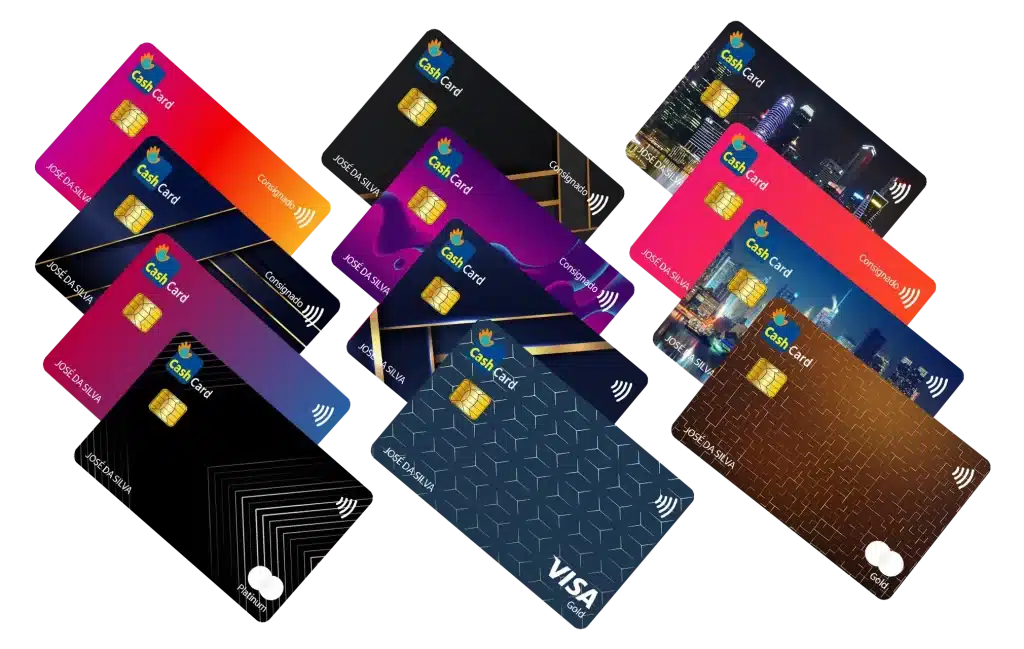

The Bank Cash Credit Card is a versatile option for those who want a simple and consistent way to earn cashback.

With no annual fee and a flat 1.5% cashback on all purchases, this card is designed to deliver value without unnecessary complexity.

Maintaining sufficient bank cash is crucial for fostering trust among customers and complying with regulatory requirements.

Central banks often set minimum cash reserve ratios to ensure that financial institutions can handle unexpected demands for withdrawals or emergencies.

In addition to serving customers, bank cash plays a vital role in supporting the broader economy.

It allows banks to provide loans, finance businesses, and stimulate economic growth.

Bank Cash

Convenient access Enjoy fastHow Does the Bank Cash Credit Card Work?

The Bank Cash Credit Card operates on a straightforward cashback rewards system. Cardholders earn a flat 1.5% cashback on every purchase, regardless of the spending category.

This eliminates the need to track categories or activate special offers, making the rewards system user-friendly and accessible to all.

New cardholders can also benefit from a generous sign-up bonus by meeting a specified spending threshold within the first few months of account opening.

This upfront reward adds immediate value to the card, providing a boost to your cashback earnings right from the start.

One of the standout features of this card is its flexibility in redeeming rewards. Cashback is automatically credited to your account and can be redeemed as statement credits, deposited into a bank account, or used for gift cards.

This ensures that your rewards are readily accessible and can be tailored to your financial preferences.

With no annual fee, the Bank Cash Credit Card is an affordable option for anyone looking to maximize rewards without incurring extra costs.

Main Benefits for the Bank Cash Credit Card

The Bank Cash Credit Card delivers several key benefits that make it a compelling choice for everyday use:

- Unlimited Cashback: The flat 1.5% cashback on all purchases ensures consistent value across all spending categories, making the card ideal for individuals with diverse spending habits.

- No Annual Fee: The lack of an annual fee ensures that all your rewards remain intact, making this card cost-effective for long-term use.

- Generous Sign-Up Bonus: New cardholders can earn a competitive bonus after meeting the initial spending requirement, providing immediate value.

- Flexible Redemption Options: Rewards can be redeemed as statement credits, deposited directly into your bank account, or used for gift cards, ensuring they align with your needs.

- Ease of Use: With no rotating categories or spending limits, the card simplifies the process of earning rewards, making it user-friendly for all types of cardholders.

These features make the card an excellent choice for individuals seeking a simple yet effective rewards system that adapts to their lifestyle.

You will be redirected to the official website

Cons for the Bank Cash Credit Card

While the Bank Cash Credit Card offers consistent and straightforward rewards, it does have some limitations:

- No Bonus Categories: The flat cashback rate means there are no elevated rewards for specific spending categories like dining, travel, or groceries, which may limit its appeal for individuals seeking higher rewards in these areas.

- Limited Perks: The card lacks premium benefits such as travel insurance, purchase protection, or extended warranties, which are available with some competing cards.

- Approval Requirements: The card requires good to excellent credit, making it less accessible to those with lower credit scores.

These drawbacks are minor for individuals who value simplicity and consistent rewards over additional perks or specialized benefits.

APR and Fees

The Bank Cash Credit Card features no annual fee, making it an affordable option for individuals seeking a reliable cashback card. The APR is variable and depends on your creditworthiness, so it’s advisable to pay off balances in full each month to avoid interest charges.

The card may also include fees for balance transfers, cash advances, or foreign transactions, so it’s important to review the terms and conditions carefully to understand the full cost structure.

How to Apply for the Bank Cash Credit Card

Applying for the Bank Cash Credit Card is a quick and straightforward process. Here’s how:

- Visit the Website: Navigate to the official website and locate the Bank Cash Credit Card application page. Click “Apply Now” to begin the application process.

- Provide Your Information: Enter your personal details, including your name, address, Social Security number, and income.

- Submit Your Application: Review your information carefully and submit your application. Many applicants receive an instant decision.

Activate Your Card: Once approved, your card will arrive within 7–10 business days. Activate it and start earning cashback immediately!